How To Apply For SBI E Mudra Loan: Here we are back again with the latest and latest version of our article which we are going to inform you not only about the E Mudra Scheme but also about How to Apply for the SBI E Mudra Loan? So, you all have to read this article till the end to get complete and proper information about this scheme.

We also want to inform you that you must keep your Aadhar Card Number, and SBI Bank Account Number while applying for a loan so you can apply smoothly.

In the end, we provide you with Quick Links to ensure that you will get all the latest articles from our website regularly.

How To Apply For SBI E Mudra Loan?

| Bank Name | State Bank of India |

| Name of the Scheme | E Mudra Scheme |

| Article Topic | How To Apply For SBI E Mudra Loan? |

| Type of Article | Latest Update |

| Who Can Apply for This Loan? | All SBI Bank Account Holders Can Apply For This Loan |

| Mode of Application | Online |

| Charges of Application | NIL |

| Requirements? | Aadhar Card Number, SBI Bank Account Number Etc. |

59 Minute Challenge, The Fastest Way To Apply How to apply for SBI e Mudra Loan?

We are welcoming all those SBI bank account holders who want to get loans under the e mudra scheme to develop their business or any other needs and so we are going to tell you how to apply for SBI e mudra loan. We are going to provide comprehensive and quality information.

Furthermore, we would like to inform you that whenever you want to apply for E Mudra Loan, you have to follow an online process here that provides step by step online application process under this loan scheme, so that all applicants Can get loans easily from this scheme.

In the end, we provide you with Quick Links to ensure that you will get all the latest articles from our website regularly.

Why Should you Apply for e-Mudra?

Pradhan Mantri E-Mudra Yojana is a good option for those people who require funds for their business-related needs. Pradhan Mantri Mudra Yojana has many benefits, which include:

- The e-Mudra program helps micro enterprises in the country to get more money

- This initiative provides loans at low interest to those who require money for business purposes

- The programme contributes to the creation of new jobs and an increase in the GDP

- The e-Mudra Yojana’s processing cost is comparatively inexpensive. While there is no processing cost for the Kishor and Shishu loan programs, there is a nominal interest rate of 0.50 per cent plus tax for the Tarun program.

Main Features of SBI e-Mudra Loan

Here are the salient features of the SBI e-Mudra Loan:

- Credit guarantee support loan scheme for Micro Units (CGFMU). National Credit Guarantee Trustee Company (NCGTC) also provides protection.

- The assurance provided by the CGFMU and NCGTC is valid for a maximum period of five years. A 60-month amortization schedule has been established for repayment under this program.

- All eligible accounts will be offered MUDRA RuPay cards

- The e-Mudra loan is one type of available credit. Working Capital and long-term loans are available from SBI.

- SBI Mudra Loan can be used for a variety of business needs, such as expanding the capacity of a company or modernizing existing facilities

- The target audience includes businesses in the manufacturing, trading and service sectors, and people in agribusiness.

Read Also –

- BOB Digital Loan Apply – घर बैठें करें पर्सनल लोन के लिए आवेदन, ये है पूरी आवेदन प्रक्रिया

- UPPSC Recruitment 2022: 303 पदों पर आवेदन का मौका, 10 जनवरी तक भरे जाएंगे फॉर्म

- MP Cooperative Bank Recruitment 2022: 2254 पदों पर मध्य प्रदेश के इस बैंक में निकली भर्ती, जाने पात्रता और सम्पूर्ण आवेदन प्रक्रिया

- ECHS Recruitment 2022: सफाईकर्मी, ऑफिसर सहित कई पद पर निकली वैकेंसी, ऐसे करें अप्लाई

Step By Step Process to How To Apply For SBI E Mudra Loan??

All those SBI Bank Account Holders who want to get Loan Under E Mudra Scheme, need to follow these steps are as under:-

- How To Apply For SBI E Mudra Loan you have to visit its Official Website Home Page which looks like this –

- Now on this page, you will get an option named Proceed For E Mudra and you have to just click on that option,

- after clicking on that option a new page will open on your computer screen which looks like this –

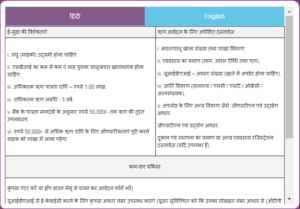

- Here you have to read all Terms and Conditions and Click on Proceed Button,

- after this, a new page will open on your computer screen which looks like this –

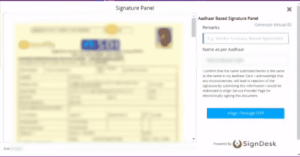

- here you have to fill in your Aadhar Card Number, SBI Bank Account Number and Amount of Loan,

- After that, you have to click on Proceed button to go to the next page which looks like this –

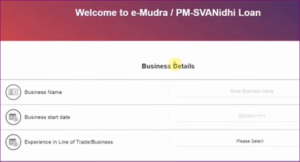

- on this page, you have to fill out this application form carefully,

- upload all the required documents and click on Proceed Button,

- after this, the Preview of your filled Application Form will open on your computer screen which looks like this –

- here you have to check all your filled information and if you found all information correct then you have to click on Final Submit Button,

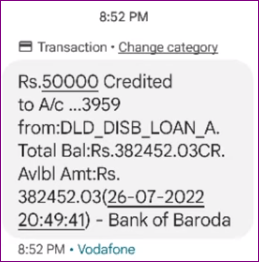

- after this, you will get an SMS from the bank of Credit with the Loan Amount in Your Bank Account which looks like this –

- On the other side on your computer screen, you will get and Congratulations Message which looks like this –

- in the end, you have to click on the Print button to get the Print Out of this receipt and keep it safe.

- After fulfilling all steps all account holders can easily apply online for the loan.

Conclusion

In this article, we try our best to inform you about the e-Mudra scheme and how to apply for SBI e Mudra loan? So, all interested applicants can easily get loans from this scheme.

At last, we hope you liked our article and so you must have liked this article, comment and share this article.

Quick Links

| Apply Link | Click Here |

What is the SBI e-Mudra loan helpline number?

If you would need any help or assistance with the SBI e-Mudra loan application, jotted down below are the SBI e-Mudra loan helpline numbers you can dial:

- 1800 1234 (toll-free)

- 1800 11 2211 (toll-free)

- 1800 425 3800 (toll-free)

- 1800 2100(toll-free)

- 080-26599990.

FAQs – How To Apply For SBI E Mudra Loan?

1. Who is eligible for the credit facility of E-Mudra? What type of borrowers does the e-Mudra scheme cover?

A: Much of the focus of this program will be on small businesses that are not corporations, such as proprietorships and partnerships that operate small factories, service units, fruit and vegetable carts, food service cart operators, truckers, and other food-related enterprises. throughout the country and in urban food processors and artisans. I am a woman who has completed training in beauty parlor and want to open my own salon.

2. For which Mudra Loan category should I apply?

A: MUDRA consists of Mahila Udyami Yojana, which is specially designed for women entrepreneurs. Women can get help under this scheme in all the three categories ‘Shishu’, ‘Kishore’ and ‘Tarun’. You need to submit your business proposal and supporting documents to the nearest branch of SBI Bank, and they will inform you about the best SBI Mudra loan interest rates and other offers that suit your needs.

3. Can people from urban areas apply for SBI MUDRA loan?

A: Yes they can. MUDRA loans are available for entrepreneurs in both rural and urban areas.

4. What exactly is MUDRA Loan Card?

A: Mudra Loan Card, also known as Mudra Card, is a credit card with a credit limit equivalent to the working capital portion of the SBI Mudra loan. It can be used as a debit-cum-ATM card for merchant purchases and at PoS terminals.

5. Does SBI require Collateral for e-Mudra Loan?

A: No, you are not required to provide any collateral as RBI has mandated that all loans for a maximum of Rs. 10 lakh for the MSE sector should be collateral-free. However, the bank requires you to pledge (mortgage) any stock, machinery, movables or other items purchased with the proceeds of the SBI Mudra loan with the bank for the term of the loan.

6. Whether financial assistance is available through SBI Mudra Loan?

A: No, there is no subsidy available for under the SBI Mudra Loan.

7. Can I apply for Mudra loan of Rs 20 lakh?

A: No, the maximum loan amount available under Mudra Loan is Rs.10 Lakh. Read more at: https://www.fincash.com/l/loan/sbi-emudra-loan